georgia estate tax rate 2020

2021 - 501 Fiduciary Income Tax Return 2020 - 501 Fiduciary Income Tax Return Prior Years - 2019 and earlier. Detailed Georgia state income tax rates and brackets are available on this page.

Counties in Georgia collect an average of 083 of a propertys assesed.

. Property is taxed according to millage rates assessed by. The statewide exemption is 2000 but it applies only to the statewide property tax which is a relatively small slice of the overall property taxes in most areas. The Georgia County Ad.

Tax amount varies by county. Then you take the 1158 million number and figure out what the. Georgia Tax Center Help Individual Income Taxes Register New Business.

Does Georgia have an estate tax. A On and after July 1 2014 there shall be no estate taxes levied by the state. Estate Tax - FAQ.

Georgia estate tax rate 2020. The Estate Tax is a tax on your right to transfer property at your death. Georgia estate tax rate 2020.

About Chatham County. Georgia Estate Tax Rate 2020. The top estate tax rate is 16 percent exemption threshold.

In Fulton County the states. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. For properties in other cities or in unincorporated.

The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. 48-12-1 was added to read as follows. Georgia Tax Brackets 2020 - 2021.

083 of home value. Unclaimed Property X About DOR Office of the Commissioner Press Releases Hearings Appeals Conferences. No estate tax or.

We will resume normal business hours Tuesday May 31. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. No estate tax or inheritance tax.

General Rate Chart - Effective July 1 2022 through September 30 2022. These vary by county. Elimination of estate taxes and returns.

This increases to 3 million in 2020 Mississippi. Prior taxable years not applicable. In a county where the millage rate is 25 mills the property tax on that house would be 1000.

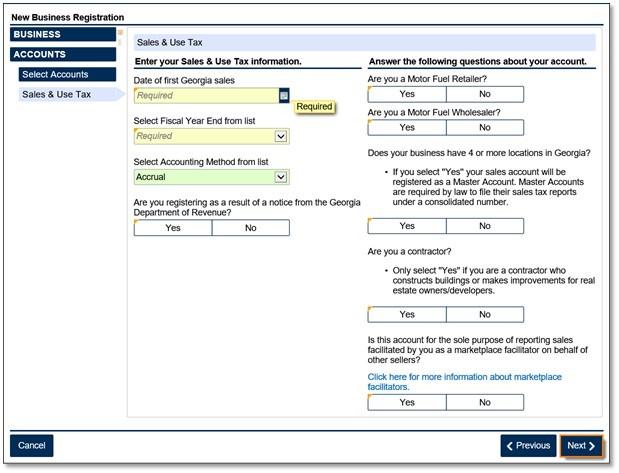

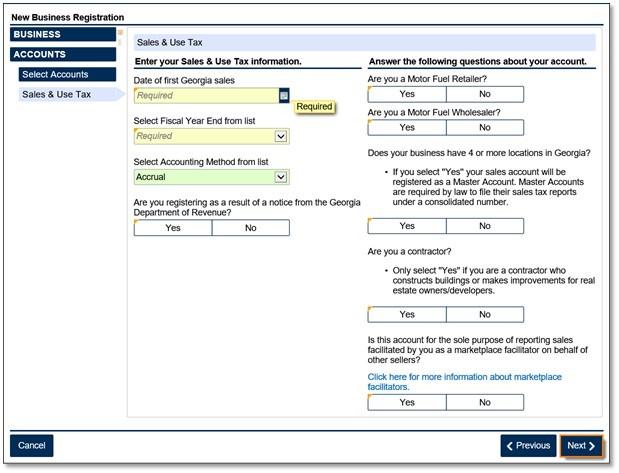

Georgia Tax Center Help Individual Income Taxes Register New Business. To successfully complete the form you must download and use. Sales Tax Rates - General.

Georgia estate tax rate 2020. Does Georgia have an estate tax. Before the official 2021 georgia income tax rates are released provisional 2021 tax rates are based on georgias 2020 income tax brackets.

Property tax and gas rates for the state are also close to the. Dor and county tag offices mv operations including in person online and. 260 plus 24 percent of the excess over 2600.

1536 Heritage Pass Milton GA 30004 in 2020 Heritage. For 2020 the basic. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000.

More specifically georgia levies the following taxes. If you reside in Berkeley Lake Dacula Grayson or Peachtree Corners this number will reflect the millage rate of your city taxes. As of July 1st 2014 OCGA.

All state offices including the Department of Revenue will close on Monday May 30 for the Memorial Day holiday. The rate remains 40 percent. Looking at the tax rate and tax brackets shown in the tables above for Georgia we can see that Georgia collects individual income taxes.

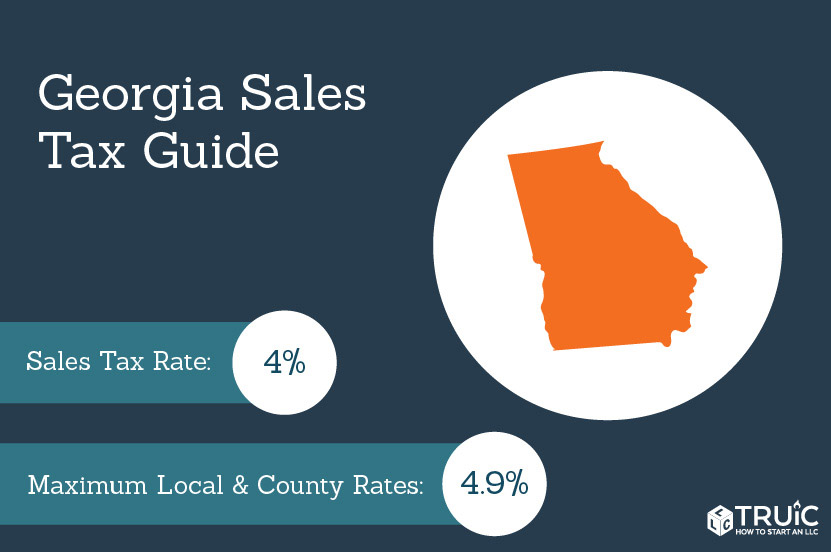

Georgia Sales Tax Small Business Guide Truic

Tax Rates Gordon County Government

Marketplace Facilitators Georgia Department Of Revenue

Llc Georgia How To Start An Llc In Georgia Truic

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

Kemp 1 1 Billion In Georgia Tax Refunds Begins This Week Wabe

913 Egmont St Brunswick Ga 31520 Mls 1604638 Zillow Zillow Foreclosures Estate Agent

Georgia Property Tax Calculator Smartasset

Tax Rates Gordon County Government

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

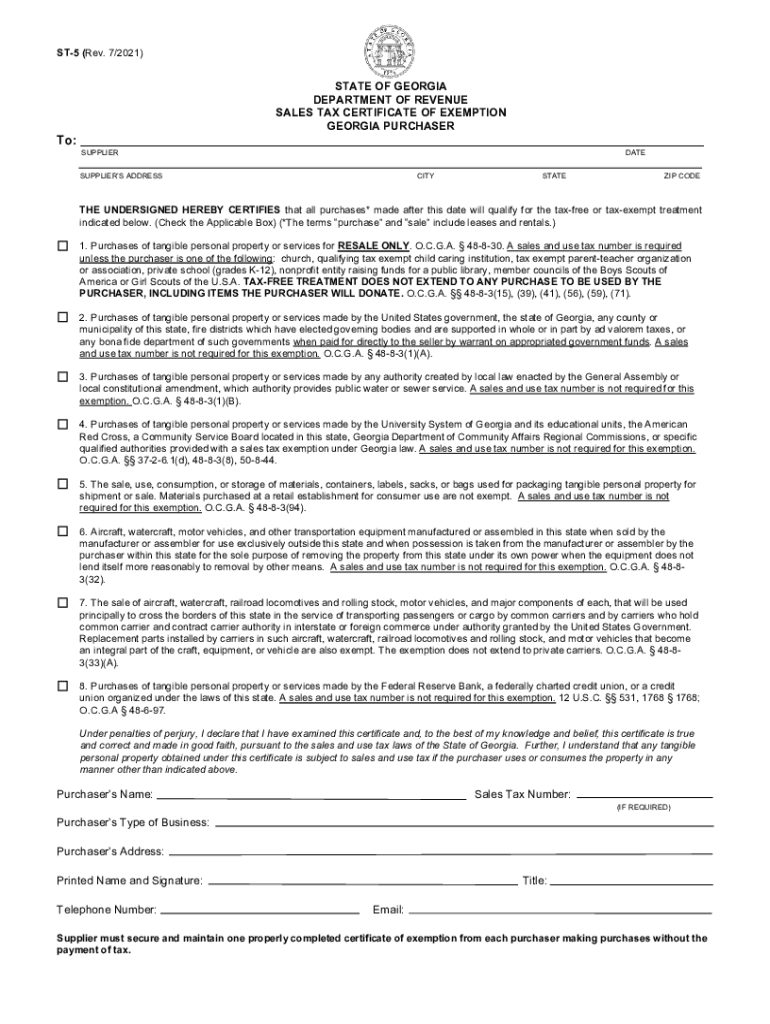

2021 Form Ga Dor St 5 Fill Online Printable Fillable Blank Pdffiller

Property Taxes Laurens County Ga

Does Georgia Have Inheritance Tax

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation